Global Crypto Exchange-Traded Products (ETP) Post $585 Million Inflows in the First Three Days of the Year

The new year has begun on a positive note for cryptocurrency investment products, with global crypto exchange-traded products (ETP) witnessing a significant influx of capital. According to recent data from CoinShares, a leading crypto investment firm, crypto ETPs have posted $585 million in inflows during the first three days of 2025. This early momentum is encouraging and suggests that investors remain optimistic about the prospects of cryptocurrencies.

Heavy Selling in the Last Two Trading Days of 2024

However, despite this positive start, crypto ETPs experienced significant outflows towards the end of last year. CoinShares reported on January 6th that heavy selling during the last two trading days of 2024 resulted in net outflows of $75 million for the full previous trading week. This dip is a reminder that cryptocurrency markets can be volatile and subject to sudden changes in investor sentiment.

Record-Breaking Year for Crypto ETFs

Despite the late-year sell-off, 2024 proved to be a record-breaking year for crypto exchange-traded funds (ETFs). With $44.2 billion in inflows, it marked a significant increase from the previous record of $10.5 billion set in 2021. The launch of spot Bitcoin ETFs in the United States contributed substantially to these inflows.

Dominance of Bitcoin and Ether

Bitcoin dominated ETF inflows in 2024, accounting for 29% of all $130 billion in total assets under management (AUM). Bitcoin-based ETPs saw significant inflows, with $38 billion poured into these products. In contrast, Ether-based ETPs experienced a resurgence towards the end of last year, leading to full-year inflows of $4.8 billion or 26% of all $18.6 billion in ETH AUM.

Flows by Assets in the Past Four Years (in Millions of US Dollars)

| Asset | 2021 | 2022 | 2023 | 2024 |

| — | — | — | — | — |

| Bitcoin (BTC) | $10.5 B | $13.8 B | $21.9 B | $38.0 B |

| Ether (ETH) | $2.7 B | $3.1 B | $2.5 B | $4.8 B |

Total AUM for All Crypto ETPs

Total assets under management (AUM) for all crypto ETPs reached an impressive $160.6 billion in 2024. This growth can be attributed to various factors, including inflows of $438 million into XRP products and $257 million into multi-asset ETPs.

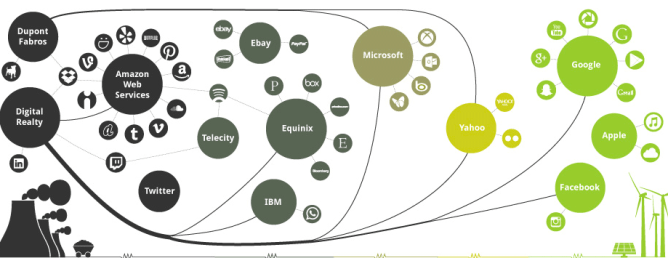

Canada Emerges as the Largest Crypto ETP Seller

While the US dominated crypto ETP inflows in 2024 with $44.5 billion, it is worth noting that Canada emerged as the largest crypto ETP seller. According to CoinShares data, Canadian crypto ETPs experienced outflows of $707 million last year.

Flows by Countries in the Past Four Years (in Millions of US Dollars)

| Country | 2021 | 2022 | 2023 | 2024 |

| — | — | — | — | — |

| United States | $14.8 B | $19.6 B | $23.5 B | $44.5 B |

| Canada | -$6.7 B | -$10.1 B | -$12.5 B | -$7.0 B |

Countries with Notable Outflows

Canada, Sweden, and Germany posted notable outflows in 2024, wiping out the inflows from countries like Switzerland and Brazil.

As we look to the future, it’s essential to consider the trends and developments that will shape the crypto landscape. Based on current market conditions and investor sentiment, here are three predictions for 2025:

- Increased adoption of SOL ETFs: As the Solana blockchain continues to gain traction, it’s likely that we’ll see increased demand for SOL-based ETFs.

- Growing role of AI in trading: Artificial intelligence (AI) is becoming increasingly prevalent in the world of finance, and it’s expected that its impact will be felt in cryptocurrency markets as well.

- New threats on the horizon: As the crypto market continues to grow and mature, new challenges are likely to emerge. It’s essential for investors to stay informed about these potential threats and develop strategies to mitigate them.

Conclusion

The start of 2025 has been marked by a surge in inflows for cryptocurrency investment products. While the last two trading days of 2024 saw significant outflows, it’s clear that investor sentiment remains positive. As we move forward into this new year, it will be essential to monitor market trends and developments closely.

Related Articles

- 3 Crypto Predictions Going Into 2025: SOL ETFs, AI Trading, New Threats

- Exploring the Rise of DeFi ETPs in Europe

Subscribe to Markets Outlook Newsletter

Stay ahead of the curve with critical insights on market trends and developments. Our newsletter is designed to help you spot investment opportunities, mitigate risks, and refine your trading strategies. Delivered every Monday.

By subscribing, you agree to our Terms of Services and Privacy Policy.